LCNB Corp (LCNB) Reports Mixed Q1 Earnings Amid Acquisitions, Misses EPS Estimates

Net Income: Reported $1.9 million, significantly below the estimated $4.8 million.

Earnings Per Share (EPS): Achieved $0.15, falling short of the estimated $0.35.

Revenue: Non-interest income rose to $3.9 million, showing a 9.7% increase year-over-year.

Asset Management: Total assets under management grew by 19.4% year-over-year to a record $3.98 billion.

Loan Performance: Net loans increased by 18.7% year-over-year to $1.65 billion, driven by organic growth and recent acquisitions.

Dividends: Paid $0.22 per share in dividends, marking a 4.8% increase from the previous year.

Acquisitions: Completed the acquisition of Eagle Financial Bancorp, Inc., expanding operational footprint to 36 full-service banking offices.

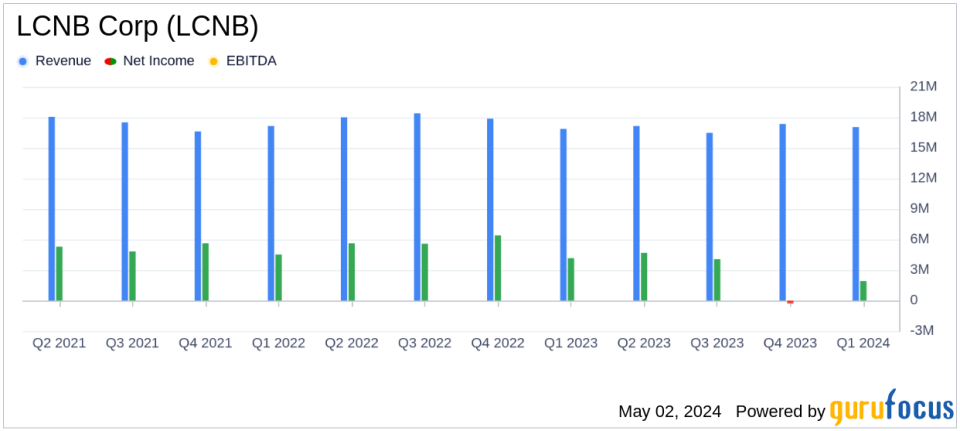

On April 29, 2024, LCNB Corp (NASDAQ:LCNB) released its 8-K filing, detailing the financial outcomes for the first quarter ended March 31, 2024. The company, a prominent player in the financial sector within the United States, reported a net income of $1.9 million, with earnings per share (EPS) standing at $0.15, significantly below the analyst estimates of $0.35 EPS and $4.80 million net income. This performance reflects the near-term costs associated with the recent acquisitions of Cincinnati Federal and Eagle Financial Bancorp, Inc. (EFBI).

Company Overview

LCNB Corp operates as the holding company for LCNB National Bank, offering a range of commercial and personal banking products and services. Its operations span across Southwest and South-Central Ohio and Northern Kentucky, focusing on strong community relationships and comprehensive financial solutions.

Quarterly Financial Performance

The reported quarter saw LCNB achieving a net interest income of $13.9 million, consistent with the previous year, despite the challenging interest rate environment which compressed the net interest margin from 3.28% to 2.73%. Non-interest income rose by 9.7% to $3.9 million, driven by higher fiduciary income and gains on sales of loans. However, the quarter was also marked by $775,000 in one-time expenses related to the acquisitions, impacting the overall profitability.

Strategic Developments and Asset Management

LCNB's strategic acquisitions have expanded its market presence, notably with the integration of EFBI completed on April 12, 2024. Total assets increased by 18.6% year-over-year to $2.28 billion, with net loans up by 18.7% to $1.65 billion. The growth in assets under management by 19.4% to nearly $4 billion underscores the bank's expanding influence and operational scale.

Balance Sheet and Capital Allocation

The balance sheet of LCNB strengthened with total deposits rising by 15.9% to $1.86 billion. The bank did not repurchase any shares during the quarter but increased its dividend payout by 4.8% to $0.22 per share, reflecting confidence in its financial stability and commitment to shareholder returns.

Asset Quality and Future Outlook

Asset quality remains robust with nonperforming loans comprising only 0.19% of total loans. Looking ahead, LCNB's management anticipates that earnings growth will reaccelerate in the fourth quarter of 2024, following the absorption of merger-related costs.

Conclusion

While LCNB's first-quarter earnings have been impacted by significant one-time costs, the strategic expansions through acquisitions are set to enhance the bank's competitive position and long-term profitability. Investors and stakeholders may expect improved performance as the benefits of these integrations begin to materialize towards the end of the year.

For detailed insights and further information, visit LCNB Corp's official website or access their full earnings report through the provided 8-K filing.

Explore the complete 8-K earnings release (here) from LCNB Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance