Integer Holdings Corp (ITGR) Q1 2024 Earnings: Surpasses Analyst Revenue Forecasts and EPS ...

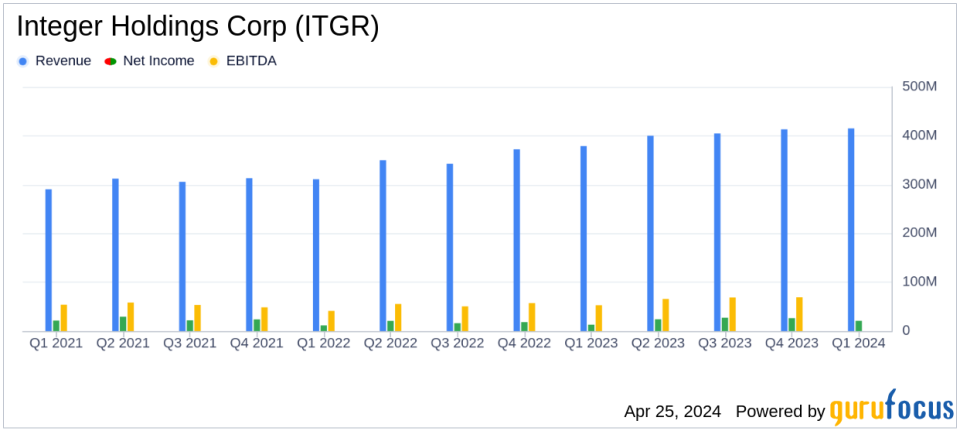

Revenue: Reported at $415 million, up 10% year-over-year, surpassing the estimated $412.83 million.

Net Income: GAAP net income reached $21 million, marking a 57% increase year-over-year, exceeding the estimated $35.68 million.

Earnings Per Share (EPS): Non-GAAP adjusted EPS was $1.14, up from $0.87 year-over-year, surpassing the estimated $1.11.

Adjusted Operating Income: Increased by 26% to $63 million, indicating strong operational efficiency.

Adjusted EBITDA: Grew 22% to $81 million, reflecting improved profitability and cost management.

Debt Levels: Total debt rose to $1.141 billion, primarily due to the acquisition of Pulse Technologies, with a leverage ratio of 3.4 times adjusted EBITDA.

2024 Financial Outlook: Reaffirmed, expecting sales growth of 9% to 11% and adjusted operating income growth of 13% to 20%.

Integer Holdings Corp (NYSE:ITGR) released its 8-K filing on April 25, 2024, revealing a strong financial performance for the first quarter of the year. The company reported a significant increase in sales and earnings, surpassing analyst expectations for both revenue and earnings per share (EPS).

Integer Holdings Corp, a leading manufacturer of medical device components, demonstrated robust growth in the first quarter of 2024. The company, which serves both medical and nonmedical sectors, reported a 10% increase in sales to $415 million, outpacing the estimated $412.83 million. This growth was driven by a 6% organic increase and further bolstered by recent acquisitions.

The company's net income saw a remarkable rise, reaching $21 million, a 57% increase from the previous year, and surpassing the estimated $35.68 million. The EPS also exceeded expectations, with a reported GAAP diluted EPS of $0.59 and a non-GAAP adjusted EPS of $1.14, compared to the estimated $1.11. This performance underscores Integer's operational efficiency and strategic acquisitions' impact.

Financial Highlights and Operational Achievements

The company's operational income reflected positive trends, with GAAP operating income growing by 15% to $39 million and non-GAAP adjusted operating income increasing by 26% to $63 million. Adjusted EBITDA also improved, marking a 22% increase to $81 million.

Integer's strategic acquisitions, including Pulse Technologies, have not only expanded its market reach but also introduced new capabilities, contributing to a 16% increase in Cardio & Vascular sales. However, the company faced challenges in the Electrochem segment, where sales normalized post an earlier surge due to supply chain recovery.

The balance sheet shows a healthy financial position despite an increase in total debt to $1.141 billion, primarily to finance acquisitions. The company's leverage ratio stood at 3.4 times adjusted EBITDA as of March 29, 2024.

Outlook and Forward Strategy

Looking ahead, Integer Holdings Corp remains optimistic about its 2024 prospects, expecting sales growth between 9% to 11% and adjusted operating income growth of 13% to 20%. The company's focus on executing its strategy and expanding margins is evident in its forward-looking statements, reflecting confidence in sustained growth and profitability.

The company's president and CEO, Joseph Dziedzic, expressed satisfaction with the strong start to the year, attributing the success to robust sales growth and significant operating income improvements. Integer's commitment to strategic expansion and operational excellence is clear as it continues to navigate the complexities of the global medical device market.

In conclusion, Integer Holdings Corp's first-quarter performance sets a positive tone for 2024, with financial metrics that not only demonstrate strong current health but also promise continued growth. This performance is crucial for the company as it continues to innovate and expand in the competitive medical device industry.

For detailed financial tables and further information, investors and interested parties are encouraged to view the full 8-K filing.

Explore the complete 8-K earnings release (here) from Integer Holdings Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance