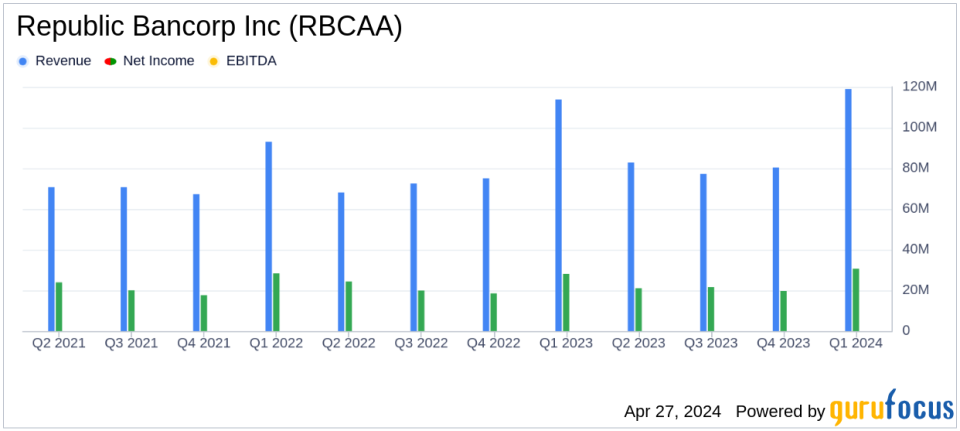

Republic Bancorp Inc (RBCAA) Surpasses Analyst Earnings Estimates in Q1 2024

Net Income: Reported $30.6 million for Q1 2024, a 9% increase from $28.1 million in Q1 2023, surpassing the estimated $21.5 million.

Diluted EPS: Achieved $1.58, an 11% rise from $1.42 in the previous year, exceeding the estimate of $1.12.

Revenue: Details on total revenue not provided, but net interest income for the Core Bank was $50.5 million, down 3% from $52.3 million in Q1 2023.

Return on Average Assets (ROA): Decreased to 1.70% in Q1 2024 from 1.81% in Q1 2023.

Return on Average Equity (ROE): Improved slightly to 13.12% in Q1 2024 from 12.78% in Q1 2023.

Loan Portfolio: Traditional Banking segment saw an 18% increase in average loan balances year-over-year.

Provision for Credit Losses: Core Bank's provision was a net charge of $667,000 in Q1 2024, significantly reduced from $3.1 million in Q1 2023.

On April 25, 2024, Republic Bancorp Inc (NASDAQ:RBCAA) released its quarterly earnings report, showcasing a robust financial performance that exceeded analyst expectations. The company reported a net income of $30.6 million and diluted earnings per share (EPS) of $1.58, surpassing the estimated earnings per share of $1.12 and estimated net income of $21.50 million for the quarter. The detailed financial results can be accessed through the company's 8-K filing.

Republic Bancorp Inc operates as a financial institution providing a mix of traditional and non-traditional banking products across six segments, with traditional banking being the primary revenue driver. The company's diversified business model has been a significant factor in its ability to navigate the current economic landscape, particularly the challenges posed by the longest inverted yield curve in U.S. history.

Financial Performance and Strategic Operations

The first quarter of 2024 saw Republic Bancorp achieving a 9% increase in net income and an 11% increase in diluted EPS compared to the first quarter of 2023. This growth was attributed to the effective diversification of revenue streams among its business segments, three of which reported increases in net income. Despite the economic pressures, including high costs of interest-bearing deposits and overnight borrowings, the company maintained strong pricing discipline, which helped improve yields across its loan portfolio.

Republic Bancorp's President and CEO, Logan Pichel, emphasized the strategic focus on long-term gains over short-term profitability, a decision that supports sustainable growth. The company also demonstrated effective cost management, with core bank noninterest expenses remaining flat year-over-year when excluding merger-related expenses from the previous year.

Challenges and Operational Highlights

The inverted yield curve has continued to squeeze net interest margins (NIM), which declined from 3.98% in the first quarter of 2023 to 3.30% in the same period in 2024. This reduction primarily resulted from a shift in funding mix and an increase in the cost of interest-bearing liabilities. However, the company's strategic adjustments in its nontraditional divisions, such as the Republic Processing Group (RPG), have mitigated some of the negative impacts from higher funding costs.

Despite a decrease in payments from the U.S. Treasury affecting the Tax Refund Solutions (TRS) segment, Republic Bancorp has implemented revenue enhancements that are expected to stabilize its financial position through the remainder of the year. The company remains optimistic about recovering from these temporary setbacks.

Looking Ahead

With industry-leading credit quality, capital levels, and client satisfaction ratings, Republic Bancorp is well-positioned for the remainder of 2024. The company's focus on maintaining a diversified and efficient operational model continues to play a crucial role in its success. Republic Bancorp's strategic decisions, aimed at long-term profitability and stability, reflect its commitment to shareholder value and customer service excellence.

Republic Bancorp Inc's performance in the first quarter of 2024 not only demonstrates resilience in a challenging economic environment but also highlights the effectiveness of its diversified business approach. As the company continues to navigate through economic uncertainties, its strong foundation and strategic initiatives are expected to drive sustained growth and profitability.

For detailed financial figures and segment-level performance, readers are encouraged to review the full earnings report and accompanying financial supplement available through the provided SEC filing link.

Explore the complete 8-K earnings release (here) from Republic Bancorp Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance