Investing in Zip Co (ASX:ZIP) a year ago would have delivered you a 120% gain

When you buy shares in a company, there is always a risk that the price drops to zero. But if you pick the right business to buy shares in, you can make more than you can lose. For example, the Zip Co Limited (ASX:ZIP) share price has soared 120% return in just a single year. It's also good to see the share price up 45% over the last quarter. In contrast, the longer term returns are negative, since the share price is 82% lower than it was three years ago.

So let's assess the underlying fundamentals over the last 1 year and see if they've moved in lock-step with shareholder returns.

View our latest analysis for Zip Co

Zip Co wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

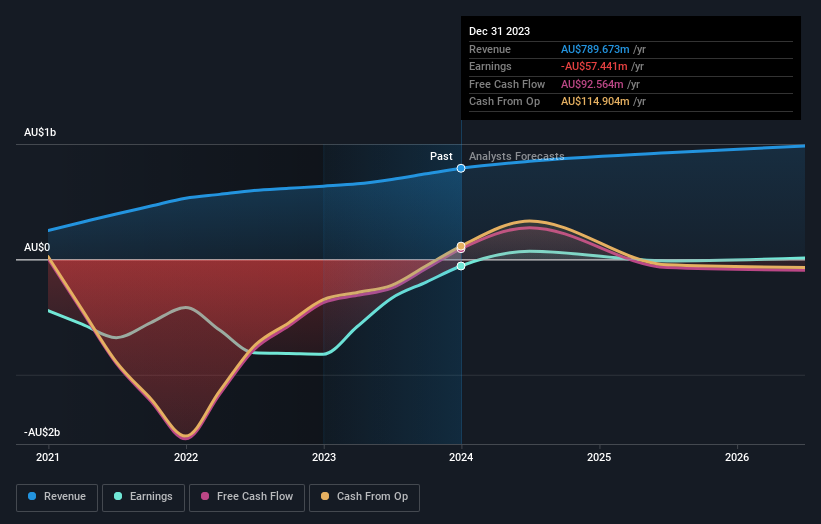

In the last year Zip Co saw its revenue grow by 24%. We respect that sort of growth, no doubt. The revenue growth is decent but the share price had an even better year, gaining 120%. Given that the business has made good progress on the top line, it would be worth taking a look at its path to profitability. Of course, we are always cautious about succumbing to 'fear of missing out' when a stock has shot up strongly.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's good to see that Zip Co has rewarded shareholders with a total shareholder return of 120% in the last twelve months. Notably the five-year annualised TSR loss of 10% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Zip Co has 1 warning sign we think you should be aware of.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance