Bharat Petroleum And Two Other High Yield Dividend Stocks

The Indian market has shown remarkable growth, surging by 45% over the past year with earnings expected to grow by 16% annually. In such a thriving economic environment, high-yield dividend stocks like Bharat Petroleum offer potential for both steady income and capital appreciation.

Top 10 Dividend Stocks In India

Name | Dividend Yield | Dividend Rating |

Balmer Lawrie Investments (BSE:532485) | 4.02% | ★★★★★★ |

Bhansali Engineering Polymers (BSE:500052) | 3.11% | ★★★★★★ |

D. B (NSEI:DBCORP) | 4.11% | ★★★★★☆ |

Castrol India (BSE:500870) | 3.66% | ★★★★★☆ |

ITC (NSEI:ITC) | 3.24% | ★★★★★☆ |

HCL Technologies (NSEI:HCLTECH) | 3.60% | ★★★★★☆ |

Indian Oil (NSEI:IOC) | 8.52% | ★★★★★☆ |

VST Industries (BSE:509966) | 3.69% | ★★★★★☆ |

Redington (NSEI:REDINGTON) | 3.36% | ★★★★★☆ |

PTC India (NSEI:PTC) | 3.71% | ★★★★★☆ |

Click here to see the full list of 19 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

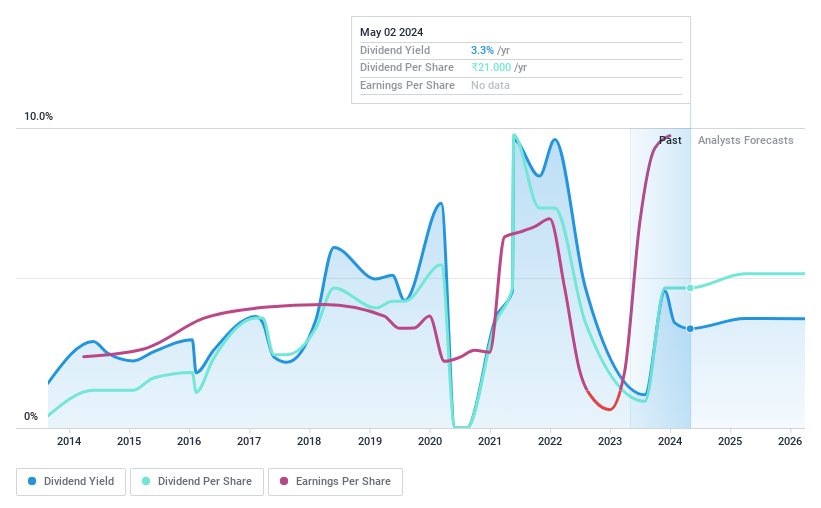

Bharat Petroleum

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bharat Petroleum Corporation Limited operates primarily in refining crude oil and marketing petroleum products across India, with a market capitalization of approximately ₹1.29 trillion.

Operations: Bharat Petroleum generates revenue primarily through its Downstream Petroleum segment, which accounted for ₹50.68 billion, and a smaller contribution from its Exploration & Production of Hydrocarbons segment at ₹1.88 billion.

Dividend Yield: 7.0%

Bharat Petroleum Corporation Limited (BPCL) has proposed a final dividend of INR 10.5 per share post-bonus, with a recent 2:1 stock split enhancing shareholder accessibility. Despite its volatile dividend history, the dividends are well-covered by earnings and cash flows, with payout ratios at 33.3% and 34.6% respectively. The company's earnings surged by 1160.4% over the past year, yet future forecasts suggest a decline in earnings growth by an average of 35.6% annually for the next three years, indicating potential challenges ahead in maintaining dividend levels without adjustments to financial strategies or operational efficiencies.

Click here to discover the nuances of Bharat Petroleum with our detailed analytical dividend report.

Our valuation report unveils the possibility Bharat Petroleum's shares may be trading at a discount.

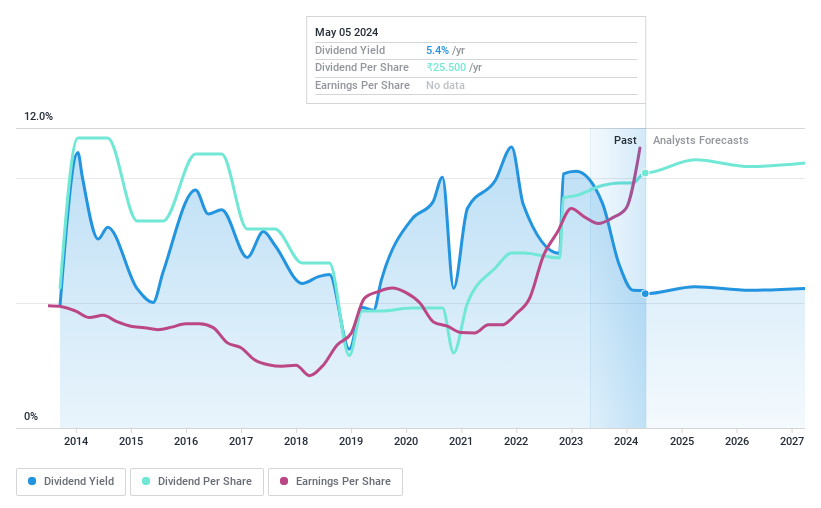

Coal India

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Coal India Limited, along with its subsidiaries, engages in the production and marketing of coal and coal products across India, boasting a market capitalization of approximately ₹2.89 trillion.

Operations: Coal India Limited generates approximately ₹1.30 billion in revenue from its coal mining and services segment.

Dividend Yield: 5.4%

Coal India's recent strategic alliance to form Bharat Coal Gasification & Chemicals Limited with BHEL, holding a 51% stake, marks a diversification into coal gasification. Despite robust production growth of 10% year-over-year and increased net income from INR 317,632.3 million to INR 374,022.9 million in FY2023-24, the company's dividends face coverage issues with a high cash payout ratio of 1226%. The dividend yield stands at an attractive 5.44%, but sustainability concerns persist due to volatile historical payouts and insufficient cash flow coverage.

Gulf Oil Lubricants India

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Gulf Oil Lubricants India Limited is a company that manufactures, markets, and trades lubricants for the automobile and industrial sectors in India, with a market capitalization of approximately ₹56.60 billion.

Operations: Gulf Oil Lubricants India generates its revenue primarily from the sale of lubricants, amounting to ₹33.01 billion.

Dividend Yield: 3.4%

Gulf Oil Lubricants India reported a robust financial year with sales reaching INR 33.01 billion, up from INR 29.99 billion, and net income increasing to INR 3.08 billion from INR 2.32 billion. Despite a high dividend of INR 20 per share reflecting a payout ratio of 57.4% and cash payout ratio of 62.7%, the company's dividend track record remains unstable due to historical volatility in payments and recent senior management changes, including the resignation of the Head Marketing and rotation of statutory auditors which could signal internal shifts impacting future stability.

Key Takeaways

Investigate our full lineup of 19 Top Dividend Stocks right here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:BPCL NSEI:COALINDIA and NSEI:GULFOILLUB.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance