Insider Sell: President and CEO Dominick Colangelo Sells 24,397 Shares of Vericel Corp (VCEL)

Vericel Corp (NASDAQ:VCEL), a leader in the field of regenerative medicine, has recently witnessed a significant insider sell by its President and CEO, Dominick Colangelo. On December 7, 2023, the insider executed a sale of 24,397 shares of the company's stock. This transaction has caught the attention of investors and market analysts, as insider activity, such as buys and sells, can provide valuable insights into a company's financial health and future prospects.

Who is Dominick Colangelo?

Dominick Colangelo has been at the helm of Vericel Corp as the President and CEO, guiding the company through various stages of growth and development. With a seasoned background in the biopharmaceutical industry, Colangelo has been instrumental in driving Vericel's strategic initiatives and expanding its product portfolio. His leadership has been pivotal in the company's efforts to deliver innovative therapies that address unmet medical needs in the areas of sports medicine and severe burn care.

Vericel Corp's Business Description

Vericel Corp specializes in the development, manufacture, and marketing of autologous cell-based therapies. The company's focus is on patients with serious diseases and conditions. Vericel's products aim to repair or regenerate damaged tissues or organs, thereby improving patient health outcomes. The company's flagship products include MACI, used for the repair of symptomatic cartilage defects of the knee, and Epicel, a permanent skin replacement for patients with severe burns. Vericel's commitment to innovation in regenerative medicine has positioned it as a key player in this rapidly evolving industry.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

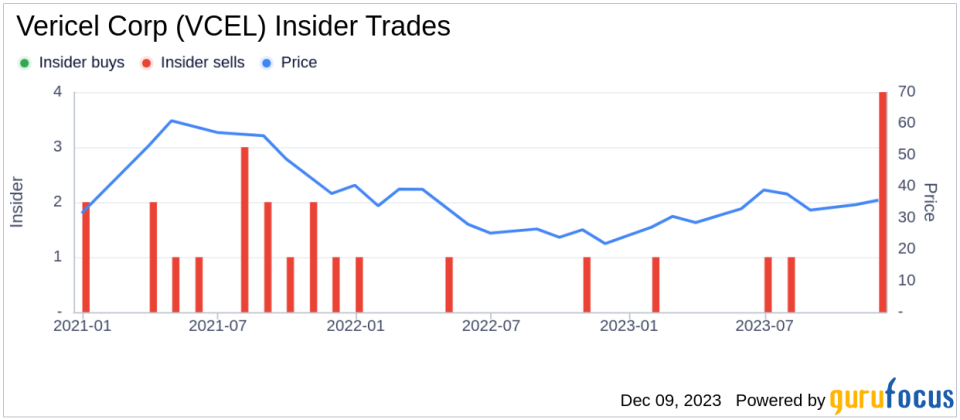

Insider transactions are closely monitored by investors as they can provide clues about a company's internal perspective on its stock's value. Over the past year, Dominick Colangelo has sold a total of 64,335 shares and has not made any purchases. This pattern of selling without corresponding buys could signal that the insider believes the stock may be fully valued or that they are diversifying their personal holdings.

However, it is important to consider these transactions in the context of the company's overall performance and market conditions. The absence of insider buys over the past year, coupled with 8 insider sells, may raise questions among investors. Yet, it is essential to analyze these actions alongside other financial metrics and market indicators before drawing conclusions.

On the day of the insider's recent sell, Vericel Corp's shares were trading at $34.14, giving the company a market cap of $1.615 billion. This valuation reflects the market's assessment of the company's current and future potential.

The insider trend image above illustrates the recent history of insider transactions at Vericel Corp. A visual representation of buys and sells can help investors discern patterns or shifts in insider sentiment over time.

Valuation and GF Value Analysis

With a trading price of $34.14 and a GuruFocus Value (GF Value) of $40.35, Vericel Corp's price-to-GF-Value ratio stands at 0.85. This suggests that the stock is modestly undervalued based on its GF Value. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which factors in historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

The GF Value image above provides a visual representation of Vericel Corp's current stock price relative to its estimated intrinsic value. When the stock price is below the GF Value, it may indicate an opportunity for investors to purchase shares at a discount, assuming the intrinsic value estimate is accurate and the market eventually recognizes the company's true worth.

Conclusion

The recent insider sell by President and CEO Dominick Colangelo at Vericel Corp has prompted investors to take a closer look at the company's stock valuation and future prospects. While insider sells can be interpreted in various ways, they are just one piece of the puzzle when it comes to evaluating a company's investment potential. Vericel Corp's position in the regenerative medicine market, its innovative product offerings, and its current valuation relative to the GF Value all play a role in assessing whether the stock is an attractive investment opportunity.

Investors should consider the broader context of the company's financial health, market trends, and the potential impact of insider transactions on stock performance. As always, a well-rounded investment decision should be based on a comprehensive analysis of all available data, including insider trends, valuation metrics, and the company's strategic direction.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance